The 20-Second Trick For Personal Loans copyright

The 20-Second Trick For Personal Loans copyright

Blog Article

Personal Loans copyright Fundamentals Explained

Table of ContentsMore About Personal Loans copyrightA Biased View of Personal Loans copyrightMore About Personal Loans copyrightPersonal Loans copyright - TruthsHow Personal Loans copyright can Save You Time, Stress, and Money.

Let's dive into what a personal funding actually is (and what it's not), the factors people utilize them, and exactly how you can cover those crazy emergency costs without tackling the problem of financial debt. An individual funding is a round figure of money you can obtain for. well, nearly anything.That does not consist of borrowing $1,000 from your Uncle John to aid you pay for Christmas provides or letting your flatmate place you for a pair months' rental fee. You should not do either of those points (for a variety of reasons), but that's practically not a personal funding. Personal finances are made with a real monetary institutionlike a financial institution, lending institution or online loan provider.

Let's take a look at each so you can understand precisely how they workand why you do not need one. Ever before.

Some Of Personal Loans copyright

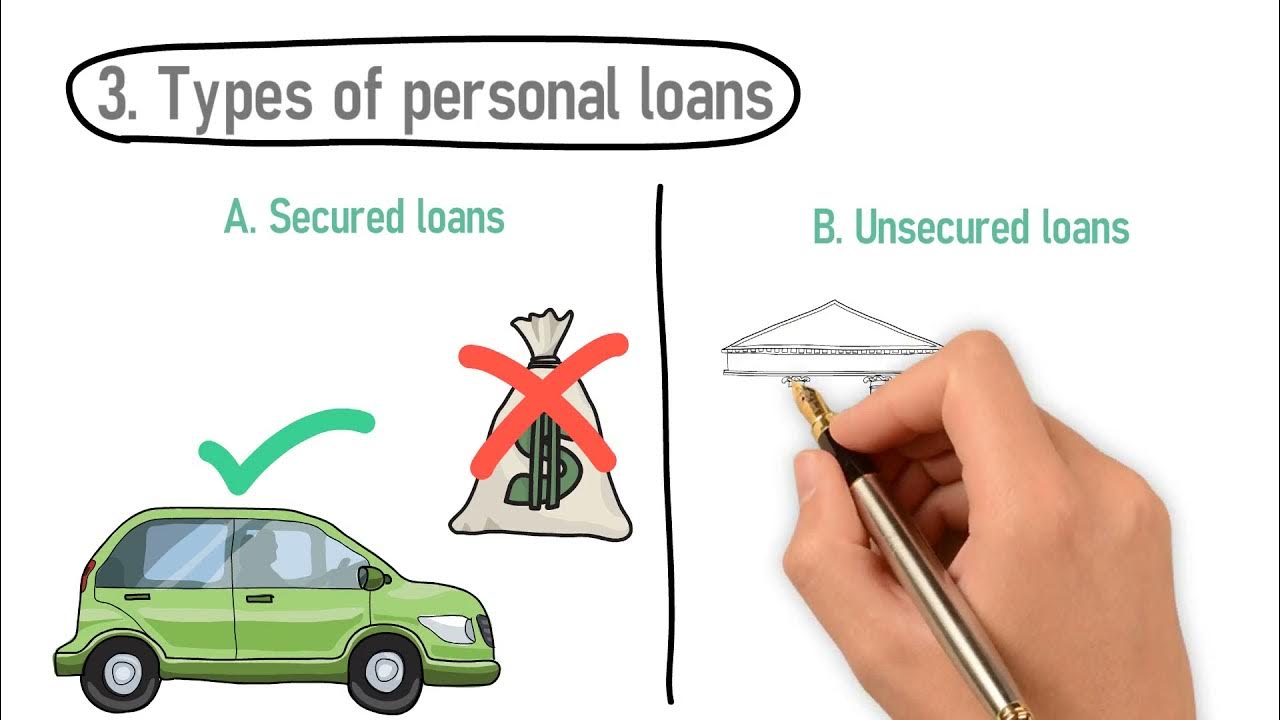

No matter just how good your credit score is, you'll still have to pay rate of interest on the majority of personal financings. Guaranteed individual lendings, on the other hand, have some sort of collateral to "safeguard" the financing, like a boat, precious jewelry or RVjust to call a couple of.

You might additionally take out a safeguarded individual financing utilizing your cars and truck as collateral. Trust us, there's absolutely nothing safe about guaranteed fundings.

However just since the payments are predictable, it doesn't indicate this is an excellent bargain. Like we stated before, you're quite much ensured to pay interest on an individual car loan. Just do the math: You'll wind up paying means much more in the lengthy run by securing a loan than if you would certainly just paid with money

Rumored Buzz on Personal Loans copyright

And you're the fish hanging on a line. An installment loan is a personal lending you pay back in taken care of installments over time (usually as soon as a month) till go to my site it's paid completely - Personal Loans copyright. And do not miss this: You need to repay the original lending quantity prior to you can obtain anything else

However don't be mistaken: This isn't the like a bank card. With line of credits, you're paying rate of interest on the loaneven if you pay in a timely manner. This sort of loan is very difficult due to the fact that it makes you think you're handling your debt, when truly, it's handling you. Payday car loans.

This one gets us provoked up. Since these organizations prey on people that can not pay their expenses. Technically, dig this these are temporary financings that give you your paycheck in advancement.

More About Personal Loans copyright

Since things obtain genuine untidy real this contact form quick when you miss out on a repayment. Those lenders will come after your pleasant granny who guaranteed the car loan for you. Oh, and you need to never guarantee a lending for anybody else either!

But all you're really doing is utilizing new financial debt to settle old debt (and expanding your loan term). That simply implies you'll be paying a lot more in time. Firms understand that toowhich is exactly why so numerous of them use you debt consolidation car loans. A lower rate of interest does not obtain you out of debtyou do.

:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

And it begins with not obtaining any kind of even more money. Whether you're thinking of taking out a personal car loan to cover that kitchen remodel or your frustrating credit scores card expenses. Taking out financial obligation to pay for things isn't the means to go.

More About Personal Loans copyright

The ideal thing you can do for your monetary future is leave that buy-now-pay-later way of thinking and say no to those spending impulses. And if you're taking into consideration a personal finance to cover an emergency situation, we get it. Borrowing money to pay for an emergency situation just rises the tension and difficulty of the circumstance.

:max_bytes(150000):strip_icc()/how-apply-personal-loan.asp-final-e0c4e2e22f254e54a6cdf927b0a4f8ab.jpg)

Report this page